Atualizado em 08/11/2024 18:43

As with all financial reports, trial balances are always prepared with a heading. Typically, the heading consists of three lines containing the company name, name of the trial balance, and date of the reporting period. Preparing an adjusted trial balance is the fifth step in the accounting cycle and is the last step before financial statements can be produced. Note that while a trial balance is helpful in the double-entry system as an initial check of account balances, it won’t catch every accounting error. Each account with a balance in your accounting system, such as accounts receivable and accounts payable, appears in the trial balance with its respective balance–debits on the left and credits on the right.

Reporting

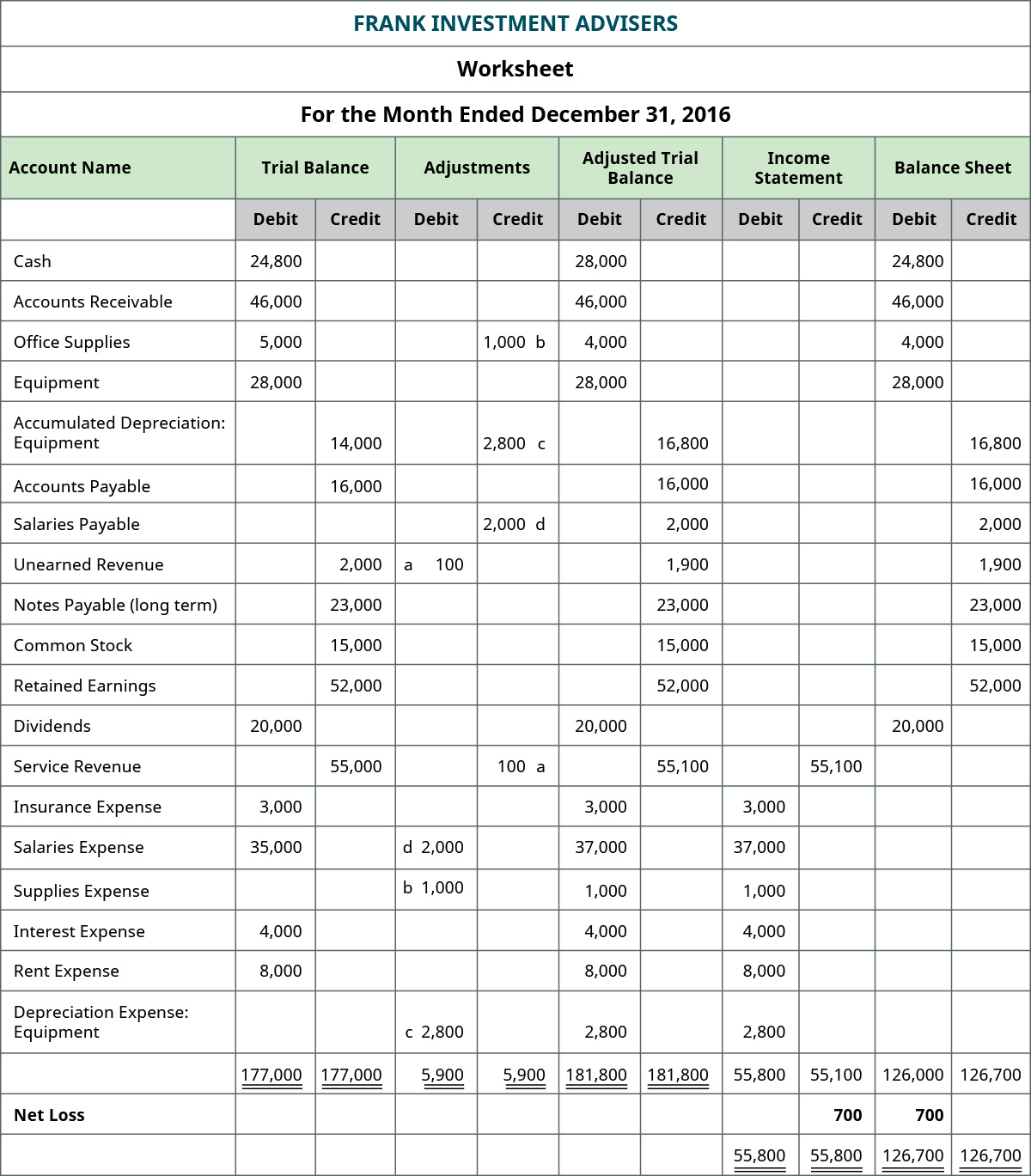

As with the unadjusted trial balance, transferring informationfrom T-accounts to the adjusted trial balance requiresconsideration of the final balance in each account. If the finalbalance in the ledger account (T-account) is a debit balance, youwill record the total in the left column of the trial balance. Ifthe final balance in the ledger account (T-account) is a creditbalance, you will record the total in the right column. We are using the same posting accounts as we did for the unadjusted trial balance just adding on. Notice how we start with the unadjusted trial balance in each account and add any debits on the left and any credits on the right. Adjusted trial balance records the account balances of an organization after adjusting the transaction to various expenses, including the depreciation amount, accrued expenses, payroll expenses, etc.

Second method – inclusion of adjusting entries directly into unadjusted trail balance:

The next step in the accounting cycle would be to complete the financial statements. Adjusted trial balance is a list of all the accounts of a business with their adjusted balances. A trial balance only contains ending balances of doubtful accounts and bad debt expenses your accounting accounts, while the general ledger has detailed transactions of the accounts. The next type of adjustment is the accrual, which ensures inclusion of the future payments that the business entity is entitled to make.

- These adjustments usually include adjustments for prepaid and accrued expenses along with non-cash expenses like depreciation.

- Notice how we start with the unadjusted trial balance in each account and add any debits on the left and any credits on the right.

- Adjusted trial balance records the account balances of an organization after adjusting the transaction to various expenses, including the depreciation amount, accrued expenses, payroll expenses, etc.

- The preparation of the adjusted trial balance is the sixth step of the accounting cycle.

- Once the posting is complete and the new balances have been calculated, we prepare the adjusted trial balance.

Cash or Accrual Basis Accounting?

Adjusted trial balance is not a part of financial statements; rather, it is a statement or source document for internal use. It is mostly helpful in situations where financial statements are manually prepared. If the organization is using some kind of accounting software, the bookkeeper or accountant just needs to pass the journal entries (including adjusting entries). The software automatically adjusts and updates the relevant ledger accounts and generates financial statements for the use of various stakeholders. Both the debit and credit columns are calculated at the bottom of a trial balance. As with the accounting equation, these debit and credit totals must always be equal.

Manage your inventory and business easier

After we post the adjusting entries, it is necessary to check our work and prepare an adjusted trial balance. This initial trial balance includes all the ledger balances before any adjustments are made. List each account and its balance, and ensure that the total debits equal total credits. Adjusted Trial Balance refers to the general ledger balances reflecting adjustments, which include accrued expenditure and non-cash expenses.

Such expenses might include paying for a rented space or any upcoming payments in the queue. Most accounting software will let you generate a trial balance at any point in time to allow you to assess the current state of your accounts. Accrued revenues are revenues earned, but not received in monetary terms, and therefore represent receivables. Hence, the trial balance includes all considerable adjustments, which is termed as adjustment trial balance.

The adjusted balances are summed to become the adjusted trial balance. Once all of the adjusting entries have been posted to thegeneral ledger, we are ready to start working on preparing theadjusted trial balance. Preparing an adjusted trial balance is thesixth step in the accounting cycle.

This, in turn, gives businesses a clear picture of where they stand. This trial balance type allows businesses have a summarized view of all the account balances post-adjustment to respective expenditures. The second method is simple and fast but is considered less systematic. This method is usually used by small companies where only a few adjusting entries are found at the end of the accounting period.

The latter are necessary in order to ensure an accurate reflection as well as consistency of business income and expenses. After the adjusted trial balance is complete, we next preparethe company’s financial statements. Creating an adjusted trial balance involves several steps, which we’ll outline below. Following these steps will help ensure that your financial records are accurate and complete. Using Paul’s unadjusted trial balance and his adjusted journal entries, we can prepare the adjusted trial balance.

It is just for the purpose of explanation, and you don’t need to change the color of account titles in your homework assignments or examination questions. Note that only active accounts that will appear on the financial statements must to be listed on the trial balance. If an account has a zero balance, there is no need to list it on the trial balance.