Atualizado em 13/11/2024 08:51

Anushka will record revenue (income) of $400 for the sale made. A trade receivable (asset) will be recorded to represent Anushka’s right to receive $400 of cash from the customer in the future. As inventory (asset) has now been sold, it must be removed from the accounting records and a cost of sales (expense) figure recorded. The cost of this sale will be the cost of the 10 units of inventory sold which is $250 (10 units x $25).

Create a Free Account and Ask Any Financial Question

- An accounting transaction is a business activity or event that causes a measurable change in the accounting equation.

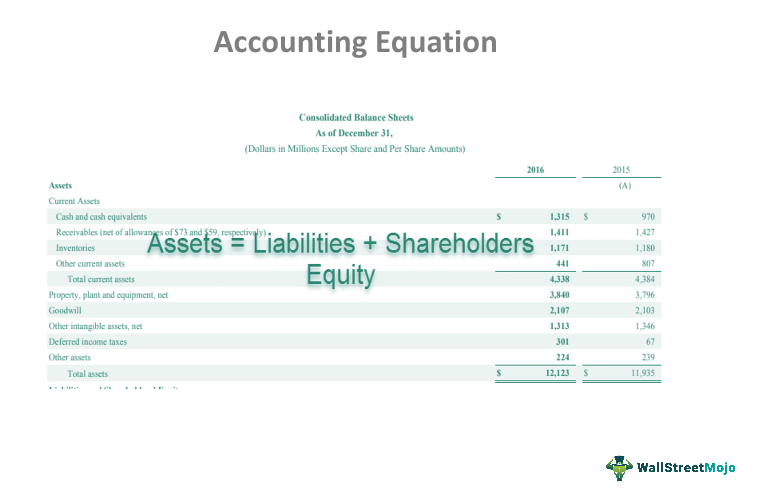

- The accounting equation’s left side represents everything a business has (assets), and the right side shows what a business owes to creditors and owners (liabilities and equity).

- Therefore cash (asset) will reduce by $60 to pay the interest (expense) of $60.

The difference of $500 in the cash discount would be added to the owner’s equity. On 12 January, Sam Enterprises pays $10,000 cash to its accounts payable. This transaction would reduce how to build value stream maps using kanban an asset (cash) and a liability (accounts payable). The Accounting Equation is a vital formula to understand and consider when it comes to the financial health of your business.

Arrangement #1: Equity = Assets – Liabilities

The income statement will explain part of the change in the owner’s or stockholders’ equity during the time interval between two balance sheets. If the left side of the accounting equation (total assets) increases or decreases, the right side (liabilities and equity) also changes in the same direction to balance the equation. In above example, we have observed the impact of twelve different transactions on accounting equation. Notice that each transaction changes the dollar value of at least one of the basic elements of equation (i.e., assets, liabilities and owner’s equity) but the equation as a whole does not lose its balance.

Impact of transactions on accounting equation

Creditors have preferential rights over the assets of the business, and so it is appropriate to place liabilities before the capital or owner’s equity in the equation. Once all of the claims by outside companies and claims by shareholders are added up, they will always equal the total company assets. The business has paid $250 cash (asset) to repay some of the loan (liability) resulting in both the cash and loan liability reducing by $250. Required Explain how each of the above transactions impact the accounting equation and illustrate the cumulative effect that they have.

Example: How to Calculate the Accounting Equation from Transactions

As expected, the sum of liabilities and equity is equal to $9350, matching the total value of assets. So, as long as you account for everything correctly, the accounting equation will always balance no matter how many transactions are involved. The accounting equation’s left side represents everything a business has (assets), and the right side shows what a business owes to creditors and owners (liabilities and equity). If a business buys raw materials and pays in cash, it will result in an increase in the company’s inventory (an asset) while reducing cash capital (another asset). Because there are two or more accounts affected by every transaction carried out by a company, the accounting system is referred to as double-entry accounting. The shareholders’ equity number is a company’s total assets minus its total liabilities.

On 28 January, merchandise costing $5,500 are destroyed by fire. The effect of this transaction on the accounting equation is the same as that of loss by fire that occurred on January 20. This transaction also generates a profit of $1,000 for Sam Enterprises, which would increase the owner’s equity element of the equation. On 2 January, Mr. Sam purchases a building for $50,000 for use in the business.

In other words, this equation allows businesses to determine revenue as well as prepare a statement of retained earnings. This then allows them to predict future profit trends and adjust business practices accordingly. Thus, the accounting equation is an essential step in determining company profitability. This straightforward relationship between assets, liabilities, and equity is considered to be the foundation of the double-entry accounting system.

At this point, let’s consider another example and see how various transactions affect the amounts of the elements in the accounting equation. The third part of the accounting equation is shareholder equity. The revenue a company shareholder can claim after debts have been paid is Shareholder Equity.

This straightforward relationship between assets, liabilities, and equity is the foundation of the double-entry accounting system. That is, each entry made on the Debit side has a corresponding entry on the Credit side. The accounting equation states that total assets is equal to total liabilities plus capital. This lesson presented the basic accounting equation and how it stays equal.

Parts 2 – 6 illustrate transactions involving a sole proprietorship.Parts 7 – 10 illustrate almost identical transactions as they would take place in a corporation.Click here to skip to Part 7. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Debt is a liability, whether it is a long-term loan or a bill that is due to be paid. This simple formula can also be expressed in three other ways, which we’ll cover next.

This equation holds true for all business activities and transactions. If assets increase, either liabilities or owner’s equity must increase to balance out the equation. The equation is generally written with liabilities appearing before owner’s equity because creditors usually have to be repaid before investors in a bankruptcy. In this sense, the liabilities are considered more current than the equity. This is consistent with financial reporting where current assets and liabilities are always reported before long-term assets and liabilities.